The biggest benefit is peace of mind.

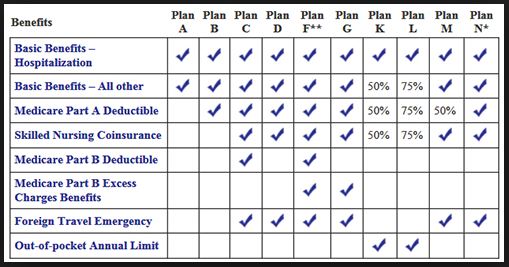

Benefits offered by each Medigap plan

Medigap policies in Florida offer different levels of coverage, but each of the standardized plans must cover certain basic benefits, regardless of the insurer you choose. These basic benefits include:

- Medicare Part A coinsurance and hospital costs: Medigap plans cover the coinsurance and hospital costs associated with Medicare Part A, which include hospital stays, hospice care, and skilled nursing facility care.

- Medicare Part B coinsurance or copayment: Medigap plans cover the coinsurance or copayment for Medicare Part B, which covers doctor visits, outpatient services, and medical equipment.

- Blood: Medigap plans cover the cost of the first three pints of blood per year.

- Part A hospice care coinsurance or copayment: Medigap plans cover the coinsurance or copayment for hospice care provided by Medicare Part A.

- Skilled nursing facility care coinsurance: Medigap plans cover the coinsurance for skilled nursing facility care provided by Medicare Part A.

In addition to these basic benefits in Florida, some Medigap plans may offer additional Medicare coverage, such as coverage for Medicare Part A and Part B deductibles, excess charges for Medicare Part B, and emergency medical care when you're traveling outside of the United States. It's important to review the benefits of each plan carefully to determine which plan offers the coverage that best meets your needs.

Don't worry about finding a new doctor, shopping for a plan each year, or network changes. With a Medicare Supplement insurance plan, you also avoid the hassle of out-of-pocket costs, which puts the control right where it belongs... with you.

Medicare Parts A and B ("Original Medicare") only cover some of your health care costs. That's where Medicare Supplement Insurance ("Medigap") comes in. Medigap plans cover some of the costs not covered by Original Medicare, like coinsurance, copayments and deductibles.

Compare the benefits of each lettered plan to help you find one that meets your needs now and in the future. You might not be able to switch Medigap policies in Florida later.

Notes:

- Plan F & Plan G also offer a high deductible plan in some states.

- Plan K & Plan L show how much they'll pay for approved services before you meet your out-of-pocket yearly limit and Part B deductible. After you meet these amounts, the plan will pay 100% of your costs for approved services.

- Plan N pays 100% of the costs of Part B services, except for copays for some office visits and some emergency room visits.

If you live in Massachusetts, Minnesota, or Wisconsin, your state offers different standardized plans than the Medigap plans in Florida.